What is the best offshore trust jurisdiction? We will do a comparison of asset protection trusts around the world. Many experts consider the offshore asset protection trust as the strongest asset protection vehicle on the planet when established in the proper jurisdiction. First, you, as the settlor, designate the trustee(s) and beneficiaries. Next, you, as settlor, covey assets to the offshore trust. Notably, only a few jurisdictions have laws that strongly favor the offshore asset protection trusts. These jurisdictions are the Cook Islands, island of Nevis and Belize. Fortunately, all three jurisdictions have laws that provide very strong asset protection and are politically stable. Furthermore, legal experts agree that the Cook Islands has the strongest of asset protection case law history. Please click here for a Cook Islands Trust illustration.

If you would like, you can name yourself as the only beneficiary to the trust. Alternatively, you can have several beneficiaries. The government does thorough background checks before they license a trustee. In addition, the offshore government regularly audits trustees. Don’t like your trustee? No problem. Just fire them and hire another. You can remain in control of the investments or you can legally require the trustee to take your direction on investments.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Click to View Cook Islands Trust Illustration

Advantages of an Offshore Trust

The major advantage of an offshore trust is asset protection. Thus, it keeps assets out of the reach of creditors. Moreover, US Judges and those in other locations do not have jurisdiction over foreign citizens. As a result, local judges cannot legally compel the foreign trustee to release funds to your judgment creditor.

The Cook Islands, Nevis, and Belize trust jurisdictions do not recognize judgments that originate in a foreign country, such as the United States. Your legal opponent must initiate any further litigation in the offshore jurisdiction in order to reach the assets. Some offshore jurisdictions place many obstacles for those who attempt to bring any litigation to the trust. In Nevis, for example, a creditor must post a $100,000 cash deposit to bring the suit against a Nevis trust. In the Cook Islands, the suit must prove beyond any reasonable doubt that the settlor transferred the assets into the trust in order to defraud the creditor in question.

Best Offshore Trust Jurisdiction

One reason why the Cook Islands Trust is one of the best offshore trust jurisdictions is its short statute of limitations on fraudulent conveyance. It states that the time limit for your opponent to claim fraudulent transfer is one year from the date of the lawsuit or two years after the underlying cause of action. Therefore, when the lawsuit is completed in the U.S., the statute of limitations in the offshore jurisdiction will usually have expired. Therefore, your creditor could not longer successfully pursue the lawsuit in the Cook Islands after that time. As a result, there are exceedingly few trust lawsuits that creditors pursue in the Cook Islands.

Moreover even if your opposition brings the lawsuit before the clock runs out, the opponent must prove that your sole intent for creating the trust was to defraud that particular creditor. To top it off, the proof must be beyond the shadow of a reasonable doubt, a very high legal hurdle. So, whereas it is best to place funds inside before legal challenges, this legal tool has consistently displayed its asset protection effectiveness after the fact.

Best Offshore Trust Jurisdiction Strategies

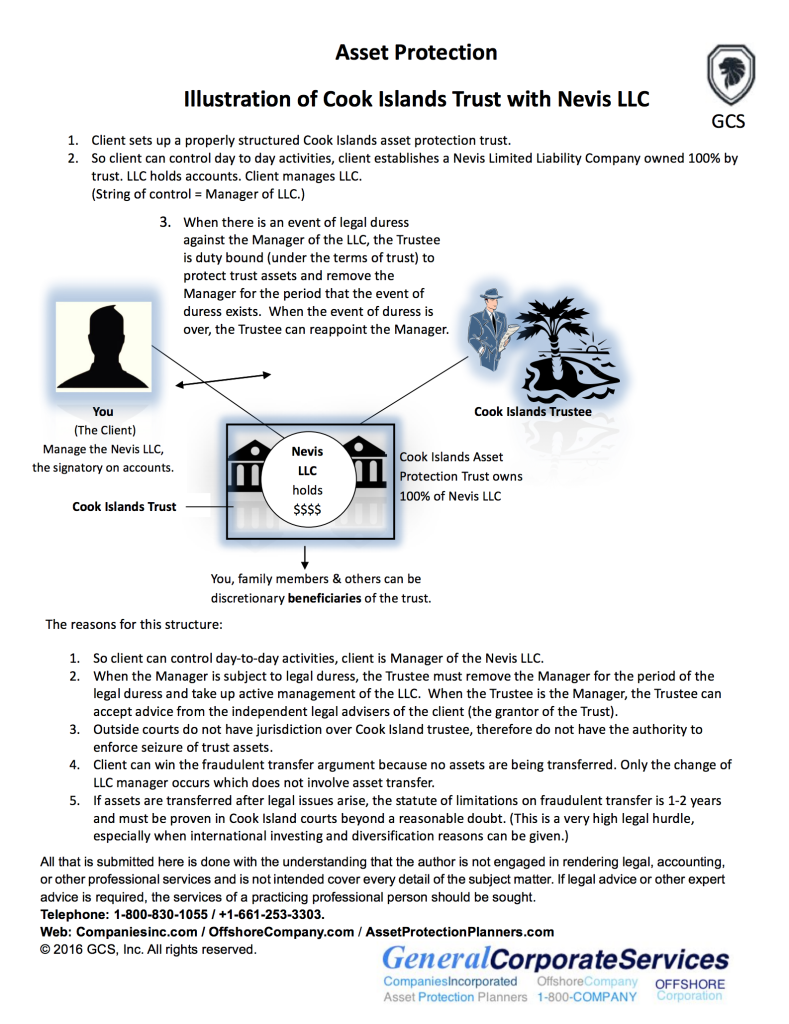

One of the best asset protection strategies combines an offshore LLC and an offshore trust such as one in the Cook Islands. You can hold assets, such as offshore bank accounts, inside of the LLC. The foreign trusts holds all the membership interest (the ownership of the LLC). A U.S. resident, such as the one having the legal tools created, can be the manager of the LLC. The manager has all legal control over the LLC and signature authority over the bank accounts. When properly structured and properly operated, it effectively protects the assets from your judgment creditor running off with them. It is possible, in this case, for a U.S. resident to control all of the assets, have full access to them, and yet own none of them.

When the “bad thing” happens, you temporarily have the licensed, bonded trustee step in as manager of the LLC and manage your accounts. Now the trustee will do for you for which you have paid: protect your assets. This way, the only time the trustee steps in on your behalf is when the courts would take your asset. When the “bad thing” goes away you, the trustee restores you as manager of the LLC.

Contempt of Court?

Occasionally clients ask if the court can hold them in contempt of court they do not bring back the funds that they have placed offshore. If a professional has properly drafted the trust, the law protects those who have placed funds therein. The protection from creditors arises from the Duress Clause. If the Trustee determines that your request for funds arises from court-ordered duress, the Trustee is duty-bound, under the terms of the trust, to step in and protect your assets.

Let’s say a judge orders you to bring back the funds. Therefore, you write a letter to the Trustee letting them know that the court has ordered you to repatriate the funds and make them available to your judgment creditor. The Trustee, in turn, responds that he senses that you wrote the letter under duress. So, it will not release the money. In practice, you tell us your predicament and we pass the news on to our Cook Islands law firm that serves as trustee.

What to Tell the Judge

On your appointed day, you return to court and inform the judge of what transpired. The judge, visibly displeased, declares his intent to hold you in contempt. Calmly, you respond:

“Hold on a minute, Your Honor. To hold me in contempt, three prima facie elements must be satisfied. First, there must be a lawful order. Certainly, there was one. Second, it must be known to the contemnor. Indeed, it was—I was standing right here when you issued it. Finally, it must have been willfully violated.”

“I did not violate your order. I demanded that the trustees return the funds, but they did not comply. Therefore, I did not willfully violate your order—it is simply impossible for me to comply.”

You follow the same reasoning if the judge attempts to compel you to revoke the trust. Domestic law protects you, while Cook Islands law protects your money.

Offshore Banking

The offshore trust is best suited for holding offshore bank and brokerage accounts. As of the most recent report from Global Finance, of the 50 safest banks in the world, only one is located in the United States. Furthermore, it is on the bottom half of the list. So, there are much safer banks located outside the U.S. than inside.

On another note, U.S. courts have jurisdiction over U.S. real estate. The domestic courts can demand seizure of such assets. Whereas, you can hold titles for domestic real estate in the Nevis LLC that the trust owns; but you should liquidate real estate and move funds moved offshore in the event of legal duress. Thus, it is best to keep the assets out of reach of the domestic courts.

Real Estate Asset Protection

So, how do we protect U.S. real estate? We do this through equity striping. That is, we record an equity line of credit mortgage or deed of trust on real estate. Then, when needed, we have an offshore finance company acquire the lien. The loan proceeds are placed in the offshore trust. It would be too risky to the lender for the borrower to run of with cash secured by foreign real estate. So, the funds are placed in account that one can access after the property is sold or refinanced.

Asset Protection and Safety

The trustee is licensed, meaning they went through intensive background checks before the government granted the license. The trustee is bonded, meaning funds that the trustee manages are insured. Moreover, the trustee company we utilize is over 30 years old. Again, with most asset protection trusts, the only event in which the trustee steps in on your behalf is when the courts threaten your funds. So the main two alternatives in such an event are as follows: 100% chance of the courts seizing the funds vs. protecting your under by a licensed, bonded trustee that has faithfully protected client funds for over 30 years.

Call us for more information or to establish a Cook Islands Trust, Cook Islands LLC or Nevis LLC and offshore account.

Call us toll free at 1-888-338-9868. International callers may call 661-253-3303