This article discusses Bermuda company setup and incorporation advantages. So, why do people incorporate companies in Bermuda? The island territory of Bermuda is known for its highly developed financial sector. Bermuda offers a number of attractive legal vehicles for those seeking asset protection through offshore incorporation. It is also a low-tax jurisdiction.

During the 2016 US presidential elections, the use of Bermuda for asset protection made international headlines. Hillary Clinton accused Donald Trump of using offshore incorporation to avoid taxes when he set up DJ Aerospace Ltd in Bermuda in 1994. Trump’s response to these claims was “That makes me smart.”

Bermuda Exempted Companies and Local Companies

The law in Bermuda allows for the incorporation through two categories of legal vehicles. This first category type has to do with the location. That is, where does the company conduct business?

Bermuda exempted companies are the most common corporate options in Bermuda. They can conduct business which is external to Bermuda. They can also conduct business with other exempted companies located within Bermuda. In certain circumstances, it is possible for an exempted company to obtain a license to conduct business within Bermuda’s borders.

Bermuda local companies, on the other hand, are owned predominantly by Bermudians to operate local businesses. Exempted companies are owned predominantly by foreign nationals. Only local companies are permitted to conduct business within Bermuda’s borders.

It is not possible to purchase shelf companies in Bermuda. Therefore, one needs to incorporate new a company in order to take advantage of Bermuda’s benefits for asset protection.

Four Bermuda Company Types

There are four different types of companies provided for under the Companies Act of 1981:

Company Limited by Shares

Under Bermudian law, a company limited by shares has the ability to limit the liability of the company’s members. It is limited to the amount that remains unpaid on the shares that they hold. This amount can be zero if there is no unpaid remainder on a member’s shares. The liability is declared via written memorandum. A Company Limited by Shares the most common type of corporation formed in Bermuda.

Company Limited by Guarantee

In a company limited by guarantee, the liability of a company’s members is limited by memorandum to an amount which members may need to contribute to the company’s assets in the event that the company is wound up. The main purpose of companies limited by guarantee in Bermuda is charitable works. These companies generally do not pay dividends.

Unlimited Liability Company

As their name suggests, in an unlimited liability company, the liability of a company’s members in unlimited. It combines all of the usual characteristics of a company, such as a board of directors, with the unlimited liability characteristic of a partnership.

Limited Duration Company

Under Bermudian law, a limited duration company is a company which is declared by memorandum to automatically dissolve at a predetermined date. This date can be a “simple” event, such as a fixed date set in the future. It can also be a “complex” event, such as the death of a shareholder with a stipulation that the date is subject to a confirmation procedure.

Benefits of Bermuda Exempted Companies

Tax Exemption

In Bermuda, there are no taxes on profits, income, or dividends paid to a Bermuda company or its shareholders. Additionally, there is no capital gains tax, estate duty, or death duty. Only shareholders who are ordinarily residents of Bermuda are subject to tax. Profits are allowed to be accumulated. It is not obligatory to pay dividends.

Bermuda even provides exempted companies with the ability to apply for legal assurance from the Minister of Finance under the Exempted Undertakings Tax Protection Act of 1966. This assurance states that, should Bermudian law change to impose tax on profits, income, or capital asset gains or appreciation, those taxes will not apply to exempted companies. Requests from exempted companies to the Minister of Finance for this assurance is usually granted.

There is no stamp duty in respect to any instrument executed by an exempted company. There is also no stamp duty on an instrument relating to an interest of an exempted company. However, stamp duty may be collected in respect to transactions involving property located in Bermuda.

Minimalist Shareholder Requirement

Under the Companies Act of 1981, businesses need only one director and one shareholder for incorporation.

Lax Reporting Requirements

Only the following items are required to be reported upon incorporation by exempted companies in Bermuda:

- The memorandum of association of the company.

- The certificate of incorporation.

- The company’s registered address

- A list of the company’s directors.

- The registrar of charges of the company.

- Any prospectus filed with the registrar.

Bermuda exempted companies are only required to make one annual filing, known as the Statutory Declaration, which lists the authorized share capital.

Aircraft registration

The Bermuda Aircraft Register has a strong reputation internationally for the registration of aircraft used for private purposes. It is regulated by the Bermuda Department of Civil Aviation (BDCA). The BDCA maintains internationally recognized standards for the licensing, operation, and maintenance of private aircraft. However, the regulatory body also maintains sensitivity and discretion towards the needs of businesses. In Bermuda, exempted companies have the ability to own private aircraft. As a result, aircraft registered in Bermuda are not subject to the claims of creditors of the corporation’s owner.

Expediency

According to the Bermuda Monetary Authority, incorporation which does not require Ministerial consent can be completed the same day that the application is received. For incorporation in which Ministerial consent is required, two to three working days should be allowed for processing following the submission of a completed application.

Bermuda Incorporation Requirements

Memorandum of Association

Together, the memorandum of association and by-laws form the constitution of an exempted company in Bermuda. The memorandum of association is on file with the Registrar. It is a matter of public record. The memorandum of association of an exempted company can be made available for inspection by the public upon request at the office of the Registrar.

By-Laws

An exempted company’s by-laws set out the rights and duties between the corporation, its shareholders, and its directors. It is not filed with the Registrar of Companies in Bermuda and is not generally made available to the public.

Registered Office

As is common in nearly all jurisdictions, exempted companies are legally required to have a registered office in in Bermuda. This is the address, typically shared with hundreds of other companies, for the purpose of receiving legal service of process. The address of this office must be on file with the Registrar.

Officers or Representation in Bermuda

Corporations in Bermuda are required by law to have one director and one secretary. The secretary can be an individual or a company. The director of an exempted company may be an individual or any other legal entity. The secretary or the director must be an ordinary resident in Bermuda in order to satisfy the residency requirement.

Officers

The directors of exempted companies can also serve as the company’s officers. It is required that the company appoint a secretary who attends all meetings of the directors and shareholders. The secretary is also responsible for maintaining the company’s records.

Bankers

Bermuda corporations are legally allowed to hold bank accounts both within Bermuda and outside its borders.

Accounting Records

Bermuda companies are required to maintain accounting records with regards to business activities. These records must be kept on file for a period of five years.

Seal

A Bermuda company may have a common seal, as well as one or more duplicate common seals either within or external to Bermuda. While corporations can have seals, they are not required. The ability to affix the seal should be described in the company’s by-laws.

Financial Year End

Exempted companies in Bermuda are required by law to declare a financial year end.

Auditors

Shareholders of a Bermuda company are required to appoint the auditors of the company. They are responsible for fixing the remuneration of the auditor. They may also delegate this responsibility to the board of directors. This requirement can be waived if all shareholders and all directors agree in writing or at a general meeting where minutes are taken.

Shareholders

Exempted companies are required to have at least one shareholder by Bermuda law. A shareholder may hold their shares as nominee for another person.

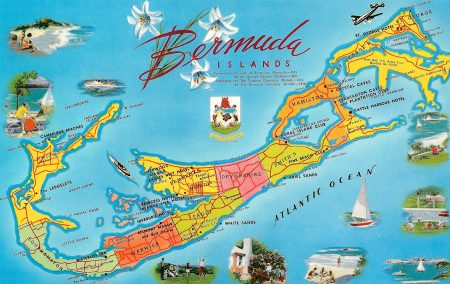

Background on Bermuda

Bermuda has the largest population of any British overseas territory. Despite being an overseas UK territory, it is self-governing. Bermuda enjoys the world’s fourth highest per capita income. The per capita GDP in Bermuda is almost 70% higher than the per capita GDP of the United States. The country is about one-third the size of Washington D.C. A group of islands located east of South Carolina in the North Atlantic Ocean, Bermuda offers a temperate climate and beautiful landscape. The nation is a popular destination for tourists, receiving about 5% of its GDP from the tourism industry. Over 80% of visitors to Bermuda come from the US.

Due to its reliance on the financial sector, Bermuda was hit hard by the global financial recession. The financial sector has lost 5,000 high paying jobs since 2008. The public debt is US$ 2.3 billion. Increases in tourist arrivals and tourism-related investment are expected to contribute to a modest economic recovery from 2018 – 2019.

Bermuda has strong anti-money laundering legislation. It has 41 Tax Information Exchange Agreements with other jurisdictions. Bermuda has also signed nine income tax treaties. The Organization for Economic Co-operation and Development (OECD) has placed Bermuda on its “white list” of countries with transparent tax practices. Bermuda is a signatory on the Convention on Mutual Assistance in tax matters. As a result, it automatically exchanges tax information on an annual basis with over 100 partner countries which belong to the convention.

Lawyers Limited manages Offshore Corporation. Please see the Lawyers Limited reviews.